montana sales tax rate 2019

The local sales tax rate in Missoula Montana is 0 as of August 2022. While the base rate applies statewide its only a starting point for calculating sales tax in Montana.

General Sales Taxes And Gross Receipts Taxes Urban Institute

Table 2Effective Property Tax RatesResidential Property.

. The minimum combined 2022 sales tax rate for Manhattan Montana is. The County sales tax. State and Local Sales Tax Rates January 2019 Key Findings Forty-five states and the District of Columbia collect statewide sales taxes.

The credit is equal to 2 of all net capital gains listed on your Montana income tax return. If your taxable income Form 2 page 1 line 14 is. You can learn more about.

2022 Montana state sales tax. We can also see the progressive nature of Montana state income tax rates from the lowest MT tax rate bracket of 1 to the highest MT tax rate bracket of 675. Get a quick rate range.

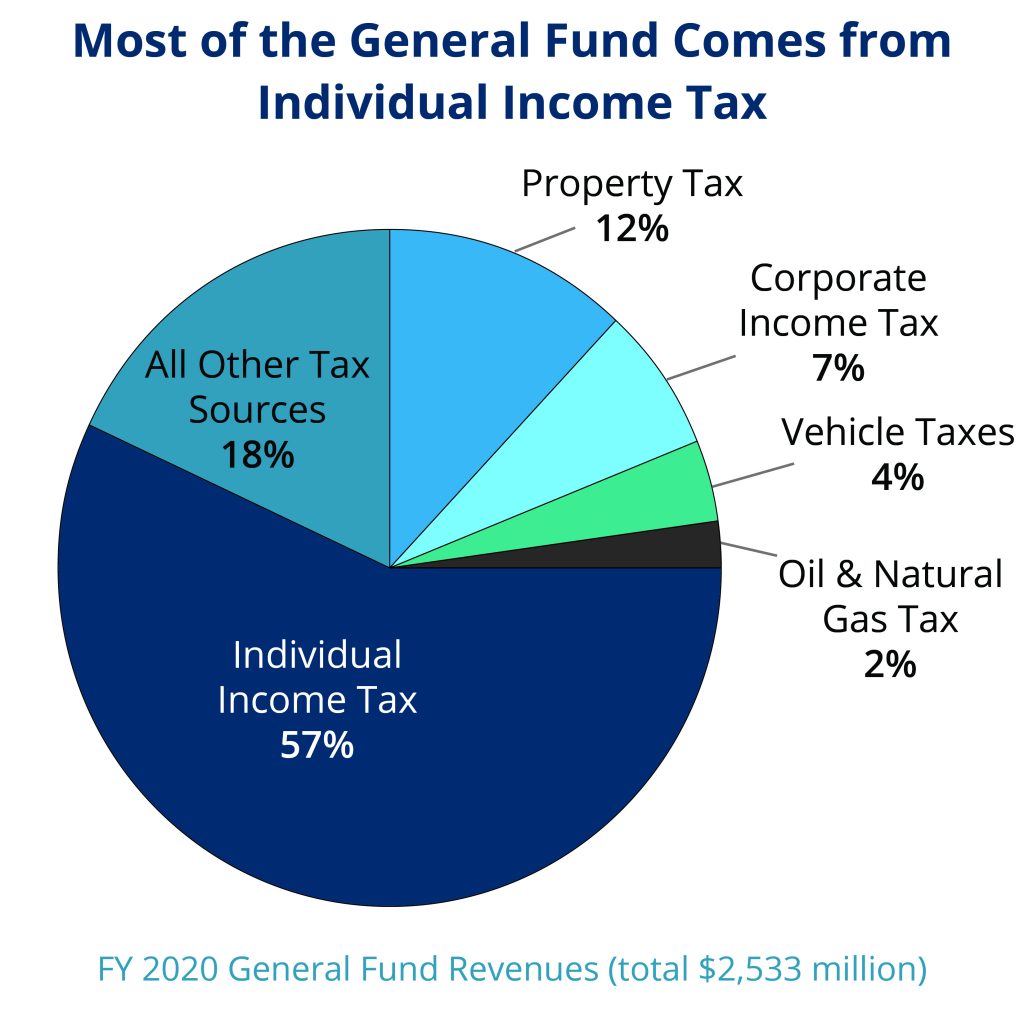

Alcoholic Beverage Taxes. Montana Individual Income Tax. Montana Sales Tax Ranges.

Montana has a graduated individual income tax with rates ranging from 100 percent to 675 percent. Local Sales Tax Range. The bill opens the door with a 25 tax that will go into effect on January 1 2020.

The state sales tax rate in Montana is 0000. Montana Constitution as amended in 1972 provides for up to a 4 sales tax. Montana does not have a.

2019 Sales Taxes Montana has no. The local sales tax rate in Opheim Montana is 0 as of September 2022. Montana is one of the five states that have no sales tax.

There are no local taxes beyond the state rate. Montana state sales tax rate. The state sales tax rate in Montana MT is currently 0.

There is no local add-on tax. In effect that lowers the top capital gains tax rate in Montana from 69 to 49. The Malmstrom A F B Montana sales tax rate of NA applies in the zip code 59402.

2019 Montana Individual Income Tax Rates. Montana charges no sales tax on purchases made in the state. Exact tax amount may vary for different items.

The Montana Department of Revenue administers the states licensing distribution and taxation on Alcoholic Beverages. The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. The Montana sales tax rate is currently.

This is the total of state county and city sales tax rates. 1 Special taxes in Montanas resort areas are not. Montana has a 675 percent corporate income tax rate.

But not more than Then your tax rate is. State Tax Rates. The Montana MT state sales tax rate is currently 0.

Combined Sales Tax Range. Effective tax rates are property taxes divid- ed by the market value of the property. The combined sale tax rate is 0.

Remember that zip code boundaries dont always match up with political boundaries like Malmstrom A F. 368 rows There are a total of 68 local tax jurisdictions across the state collecting an average. Base State Sales Tax Rate.

Base state sales tax rate 0.

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Florida Sales Tax Rates By City County 2022

Ci 121 Montana S Big Property Tax Initiative Explained

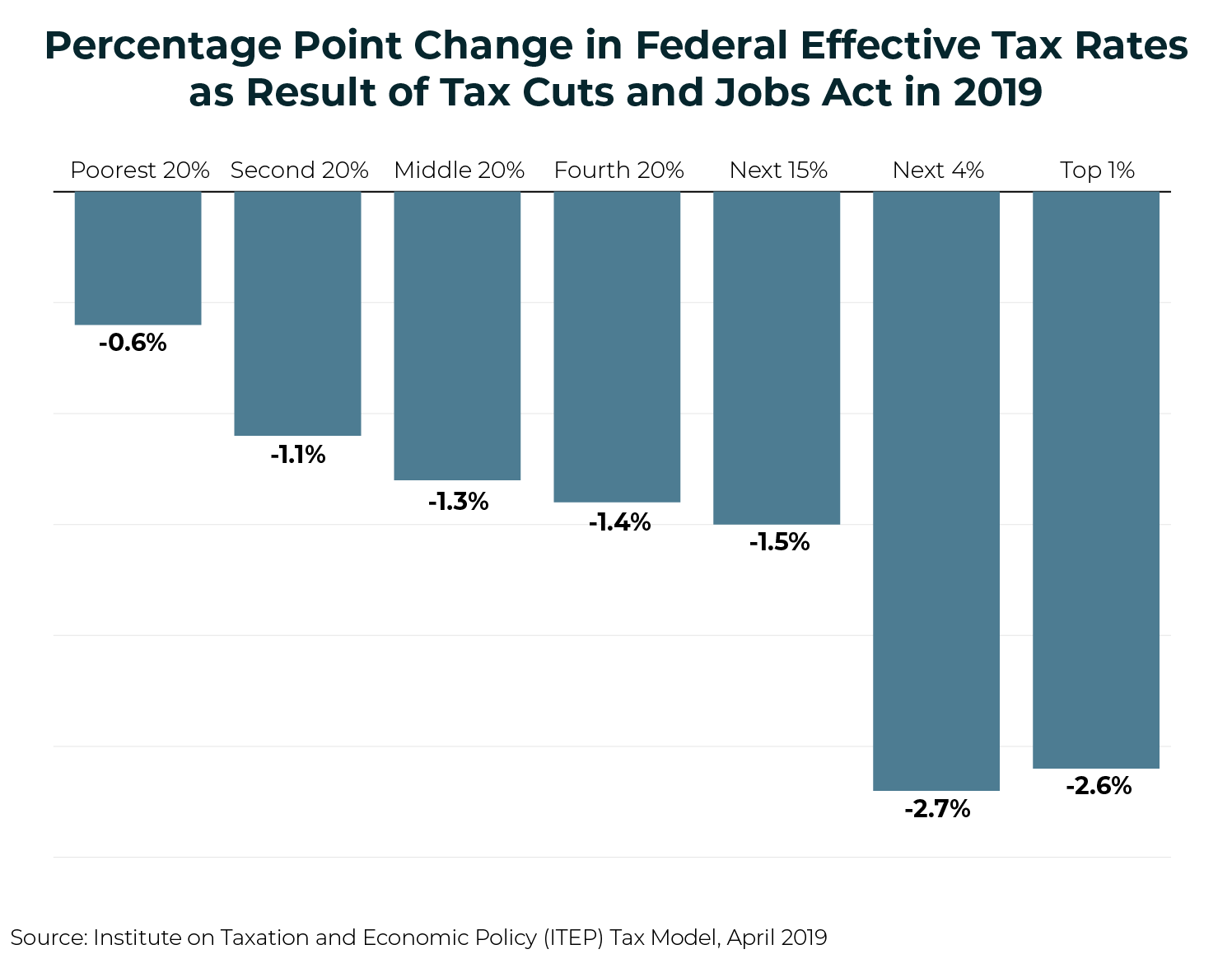

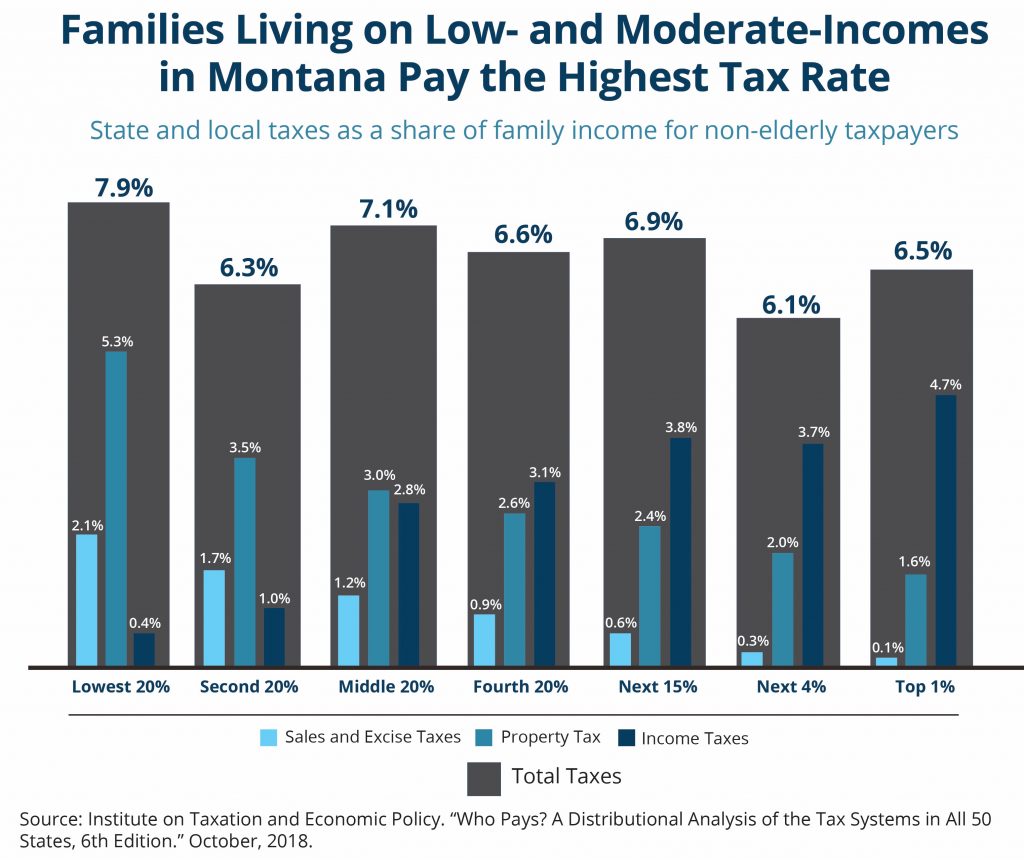

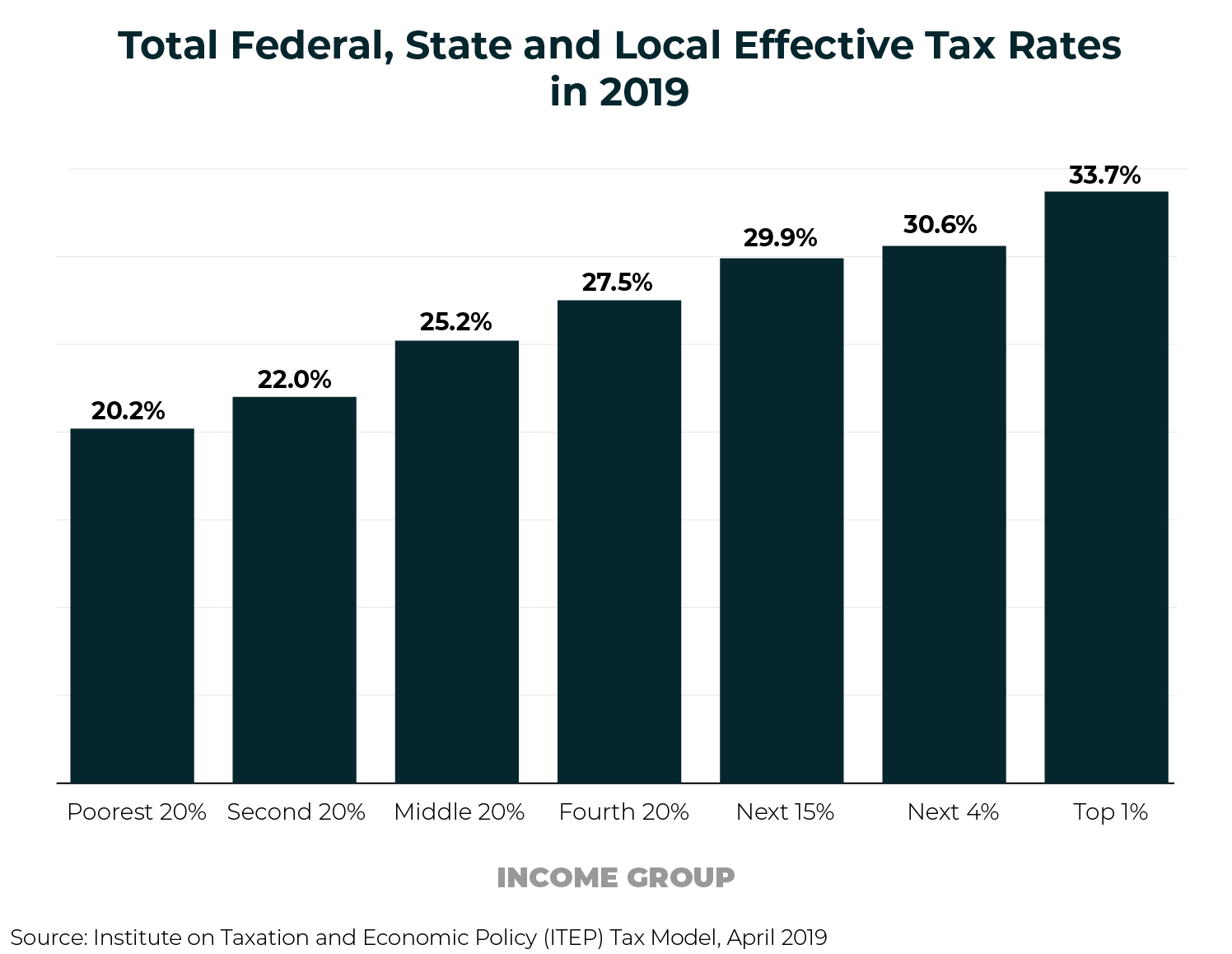

Who Pays Taxes In America In 2019 Itep

What States Impose Sales Use Tax Sales Tax Institute

.png)

Combined State And Average Local Sales Tax Rates Tax Foundation

Sales Taxes In The United States Wikipedia

Taxes Fees Montana Department Of Revenue

What Small Business Owners Need To Know About Sales Tax

Sales Taxes In The United States Wikipedia

Property Taxes Urban Institute

State And Local Sales Tax Rates Midyear 2019 Tax Foundation

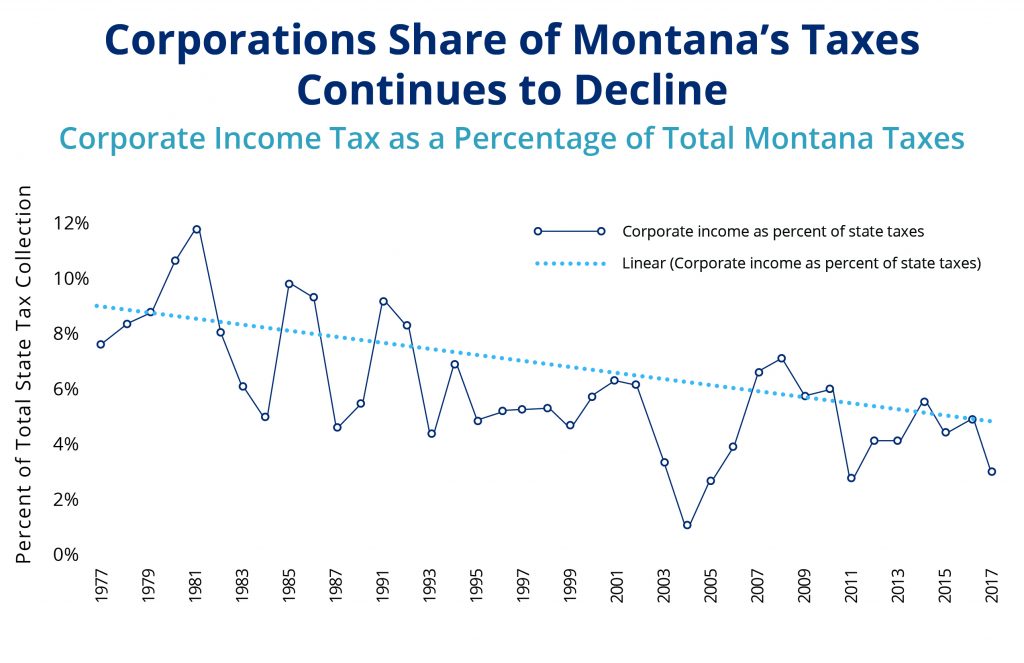

Policy Basics Corporate Income Taxes In Montana Montana Budget Policy Center

Policy Basics Individual Income Taxes In Montana Montana Budget Policy Center

State Sales Tax Rates Sales Tax Institute

Fuel Taxes In The United States Wikipedia