lincoln ne sales tax calculator

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. Just enter the five-digit zip.

8 Sales Tax Calculator Template

Sales tax in Lincoln Nebraska is currently 725.

. Lincoln NE Sales Tax Rate. L Local Sales Tax Rate. The Nebraska state sales and use tax rate is 55 055.

Nebraska Capital Gains Tax. You can calculate Sales Tax manually using the formula or. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Lincoln NE.

S Nebraska State Sales Tax Rate 55 c County Sales Tax Rate. All numbers are rounded in the normal fashion. Long- and short-term capital gains are included as regular income on your Nebraska income tax return.

Ad Get Nebraska Tax Rate By Zip. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 583 in Lincoln County Nebraska. ArcGIS Web Application - Nebraska.

The Nebraska NE state sales tax rate is currently 55. This is the total of state county and city sales tax rates. Free Unlimited Searches Try Now.

The sales tax rate for Lincoln was updated for the 2020 tax year this is the current sales tax rate we are using in the Lincoln Nebraska Sales. As of 2019 the Nebraska state sales tax rate is 55. Its important to note that some items are exempt from sales tax in Nebraska including prepared food and related ingredients.

800-742-7474 NE and IA. Sr Special Sales Tax Rate. The December 2020 total local sales tax rate was also 7250.

The current total local sales tax rate in Lincoln NE is 7250. The 2018 United States Supreme Court decision in South Dakota v. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

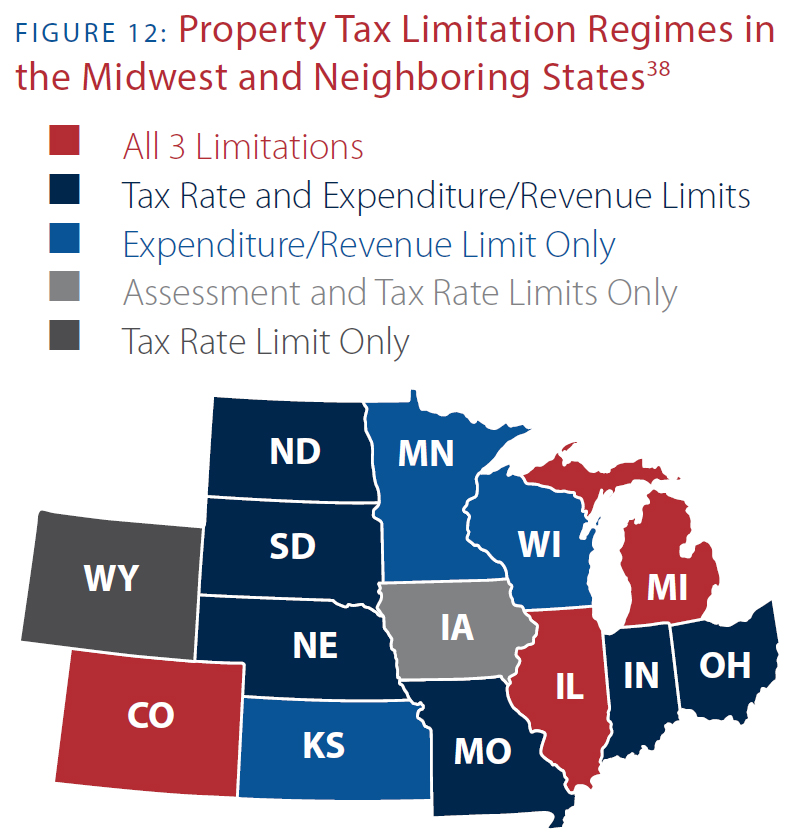

Nebraska has a 55 statewide sales tax rate but. Real property tax on median home. Nebraska Department of Revenue.

The December 2020 total local sales tax rate was also 5500. The Nebraska state sales tax rate is currently. The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax.

The Nebraska state sales and use tax rate is 55 055. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. The average cumulative sales tax rate in Lincoln Nebraska is 719 with a range that spans from 55 to 725.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Lincoln NE. Sales Tax State Local Sales Tax on Food. This includes the rates on the state county city and special levels.

The Nebraska sales tax rate is currently. The minimum combined 2022 sales tax rate for Lincoln Nebraska is. That means they are taxed at the rates.

The Lincoln County sales tax rate is. The current total local sales tax rate in Lincoln County NE is 5500. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

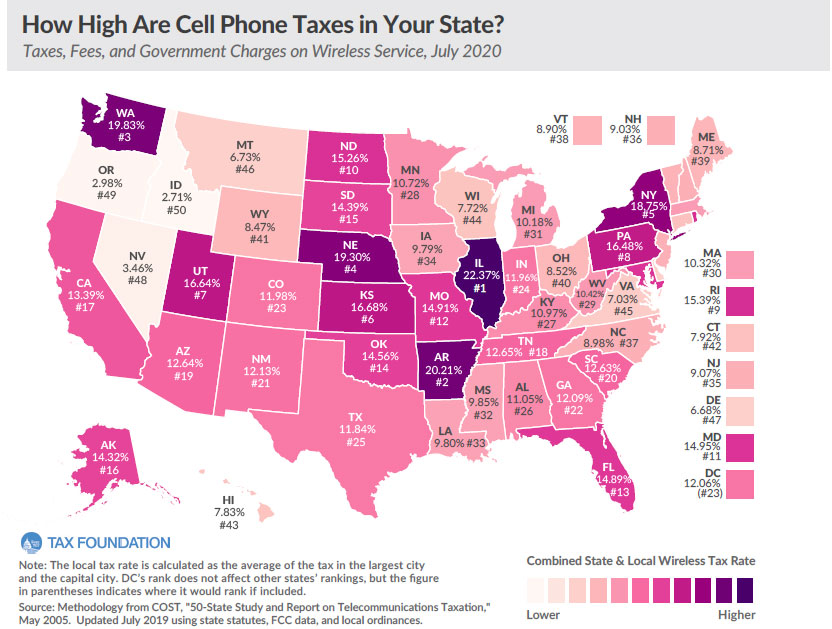

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

Washington Sales Tax Rates By City County 2022

Nebraska Income Tax Calculator Smartasset

Sales Use Tax South Dakota Department Of Revenue

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Nebraska Sales Tax Small Business Guide Truic

Sales Use Tax South Dakota Department Of Revenue

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

California Sales Tax Small Business Guide Truic

Home League Of Women Voters Of Greater Omaha

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Gross Receipts Location Code And Tax Rate Map Governments

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

Nebraska Property Tax Calculator Smartasset

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities